According to new research app downloads were unchanged in the fourth quarter

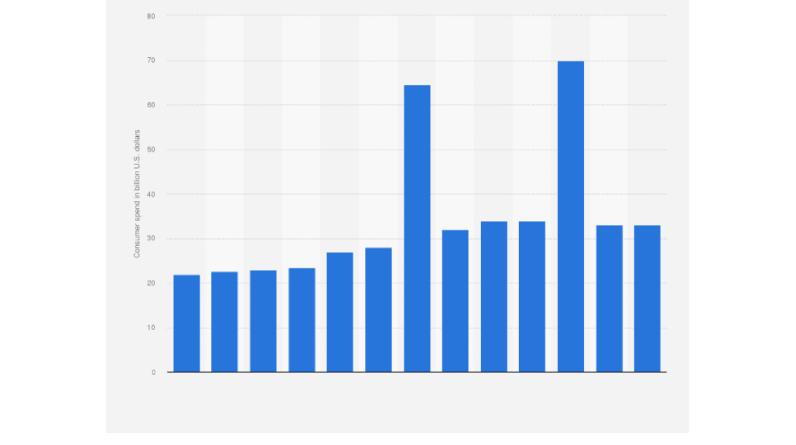

According to a recent annual report released by data.ai, consumer spending on apps decreased 2% to $167 billion last year, signalling the first-ever slowdown in the worldwide app economy. Downloads were also up 11% year over year, giving the impression that app adoption was still happening and was being particularly fueled by emerging markets. However, a more thorough examination of the fourth quarter shows that download growth has recently slowed during a season that is generally favourable for the app ecosystem. These new numbers are even the more startling because the holiday season often brings new phones and more free time for customers to try new applications and games.

Mobile app usage across the App Store and Google Play Store levelled off in Q4 2022, declining just 0.1% year over year to reach 35.5 billion new instals in the quarter, according to app intelligence company Sensor Tower.

It bases its analysis on a per-user model, so additional app downloads by the same user on several devices are not added to the total. Additionally, in order to reflect only fresh download increases, it does not count app re-installs. However, they are merely projections.

Even though the fourth-quarter trends weren’t enough to lower the overall year-over-year download growth metrics, it appears to be another sign of a stagnating app economy. This economy is undoubtedly still settling after the outsized growth experienced during Covid and is still influenced by general macroeconomic forces, which also have a significant impact on the amount of money spent on app marketing.

Another point that could be made is that the years of expensive commissions on in-app purchases and app sales across the international app stores have now started to have an effect on the innovation happening in the broader app ecosystem. Companies will find it more challenging to withstand a storm like a weak economy if they must share up to 30% of their income only to distribute their apps and games to a mobile audience. Additionally, when other markets have fewer stringent regulations, business owners could be less motivated to develop expressly for mobile. Consider the advancements in crypto and Web3, which were unable to fully transition to mobile due to app store policies and the platforms’ need to make money from in-app purchases. It’s hardly shocking to see a decline in downloads and spending when there’s so much pressure on app innovation.

This pattern is not just visible in the indicators related to the dropping spending and stagnant app instal rates.

Also Read :Adults with ADHD experience greater mental health issues than physicians had predicted.

The failure of the ecosystem is also evident in Apple’s best app for 2022, which was chosen by editorial staff. BeReal, a Gen Z social networking app, was named the “App of the Year” by the Cupertino firm as a way to highlight the possibility in developing for mobile. Although it may have become popular among young people, this app’s daily active users have fallen far behind its download numbers, and it currently has no business model because it doesn’t make money. Instead of app stores’ capacity to offer a platform where fresh ideas can readily monetise, VC funding is what keeps it alive. And as a result of an app marketplace that persuaded users for years that mobile software should be free, its developers are having trouble coming up with the kind of subscription or in-app purchases they can persuade their youthful customers to pay for.

Then there are the apps that are competing with one another for the top spots on Sensor Tower’s list of the most downloaded apps in Q4 2022, including those from tech behemoths like Meta and ByteDance. There haven’t been many entrants to this list in years, and the fourth quarter is no exception.

Leave a reply

You must be logged in to post a comment.